Blogs

Recent Posts

- Bank Statement Analysis Strategies for Today’s Challenges

- How Automated Bank Statement Extraction Accelerates Loan Approvals

- Credit Appraisal Process: How Technology and Data Are Enhancing It

- Lenders Face RBI Scrutiny: Will Credit Growth Take a Backseat?

- Leveraging Duration Gap Analysis for Effective Asset-Liability Management

Categories

Top 10 Search Terms

Mumbai

Mumbai

303, K L Accolade, Rd Number 6, T.P.S III,

Golibar,Santacruz East, Mumbai,

Maharashtra – 400055

Bengaluru

Bengaluru

Beyond Epic Co-working Space,HM Vibha Towers,

4th Floor, Above Chroma store,Next to Forum Mall,

Adugodi, Koramangala,Bangalore – 560029

Pune

Pune

Rachana Park, 3rd Floor,Atreya Society,

Off. Senapati Bapat Marg,Wadarvadi, Pune,

Maharashtra – 411016

© All Rights Reserved • Precisa • MADE WITH ❤️ & ⚡ IN INDIA

Blog

What Are Early Warning Signals in Banks for Liquidity Profile of Businesses?

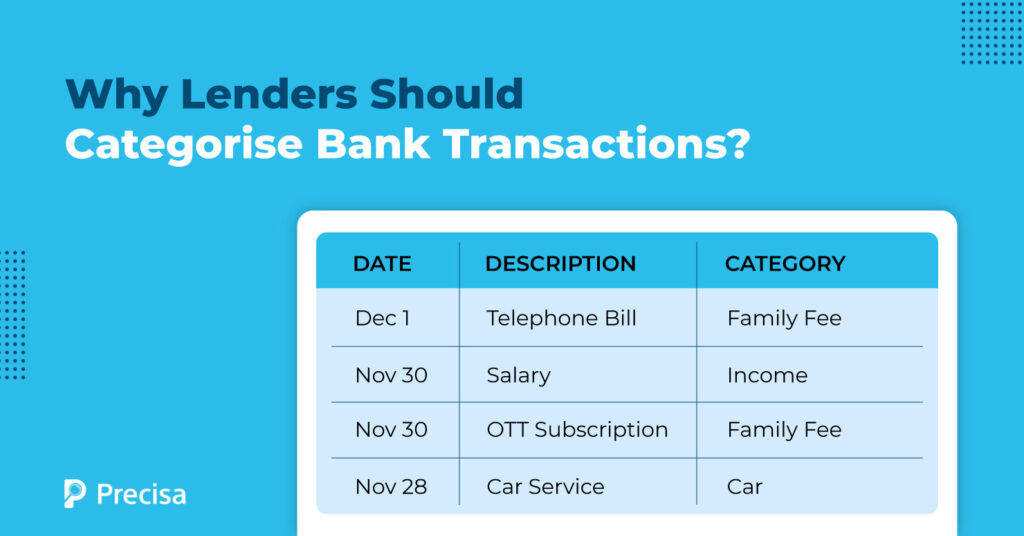

Why Lenders Should Categorise Bank Transactions (And How To Do It)

Fintech Startups: SWOT Analysis of RBI Regulations Regarding Consumer Borrowing

How to Leverage Balance Sheet Analysis to Make Informed Credit Decisions?

How Account Aggregators are Using ‘Informed Consent’ and Revolutionising Digital Lending

Managing Risks of AI in Finance: Governance and Control

AI in Banking: Why Financial Institutions are Betting Big on Artificial Intelligence?

5 Ways AI in Banking Can Upend Traditional Banking Processes

Benefits of Cloud-Based NBFC Software for Financial Services Companies

How Credit Appraisal Systems Use Data Analytics to Promote Responsible Lending

Recent Posts

- Bank Statement Analysis Strategies for Today’s Challenges

- How Automated Bank Statement Extraction Accelerates Loan Approvals

- Credit Appraisal Process: How Technology and Data Are Enhancing It

- Lenders Face RBI Scrutiny: Will Credit Growth Take a Backseat?

- Leveraging Duration Gap Analysis for Effective Asset-Liability Management

Categories

What Are Early Warning Signals in Banks for Liquidity Profile of Businesses?

Why Lenders Should Categorise Bank Transactions (And How To Do It)

Fintech Startups: SWOT Analysis of RBI Regulations Regarding Consumer Borrowing

How to Leverage Balance Sheet Analysis to Make Informed Credit Decisions?

How Account Aggregators are Using ‘Informed Consent’ and Revolutionising Digital Lending

Managing Risks of AI in Finance: Governance and Control

AI in Banking: Why Financial Institutions are Betting Big on Artificial Intelligence?

5 Ways AI in Banking Can Upend Traditional Banking Processes

Benefits of Cloud-Based NBFC Software for Financial Services Companies

How Credit Appraisal Systems Use Data Analytics to Promote Responsible Lending

Recent Posts

- Bank Statement Analysis Strategies for Today’s Challenges

- How Automated Bank Statement Extraction Accelerates Loan Approvals

- Credit Appraisal Process: How Technology and Data Are Enhancing It

- Lenders Face RBI Scrutiny: Will Credit Growth Take a Backseat?

- Leveraging Duration Gap Analysis for Effective Asset-Liability Management

Categories

Mumbai

Mumbai

303, K L Accolade, Rd Number 6, T.P.S III,

Golibar,Santacruz East, Mumbai,

Maharashtra – 400055

Bengaluru

Bengaluru

Beyond Epic Co-working Space,HM Vibha Towers,

4th Floor, Above Chroma store,Next to Forum Mall,

Adugodi, Koramangala,Bangalore – 560029

Pune

Pune

Rachana Park, 3rd Floor,Atreya Society,

Off. Senapati Bapat Marg,Wadarvadi, Pune,

Maharashtra – 411016

© All Rights Reserved • Precisa • MADE WITH ❤️ & ⚡ IN INDIA